Deploy next-gen mobile money services, we

take care of the rest

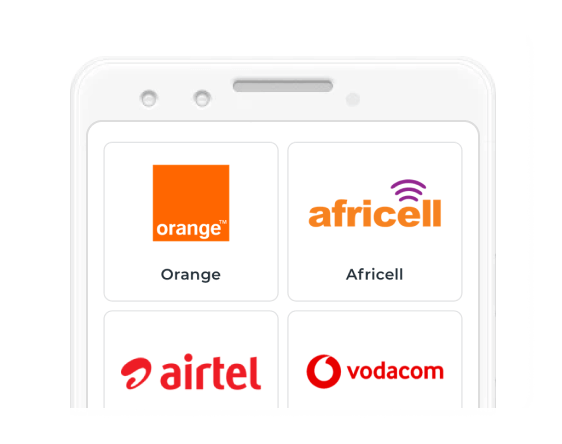

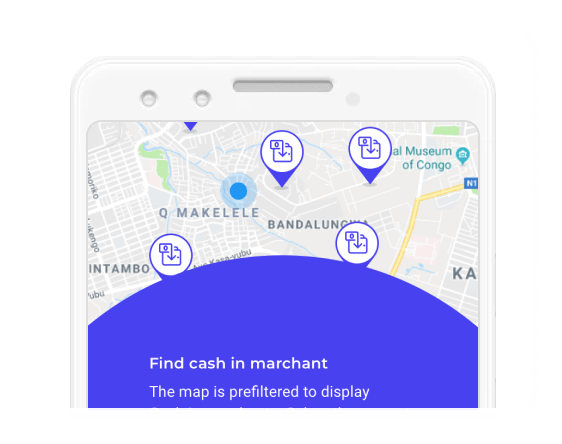

Introducing Dinero Cash - the cutting-edge mobile wallet platform revolutionizing the way financial institutions interact with their clients, merchants, and business partners. Our state-of-the-art technology is designed to empower financial institutions with the tools they need to create a powerful ecosystem of mobile money services that will change the game.

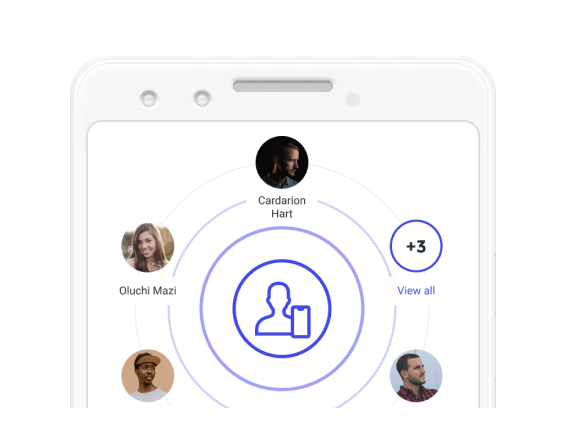

Enhance your user base and expand your reach with Dinero Cash.

Our cutting-edge mobile money platform empowers you to grow your user base, offer new services, and expand your reach like never before. With our advanced digital marketing tools, you can solidify your customer base and attract new clients, positioning your institution at the forefront of the mobile money revolution. Join the Dinero Cash network today and see your financial institution thrive.

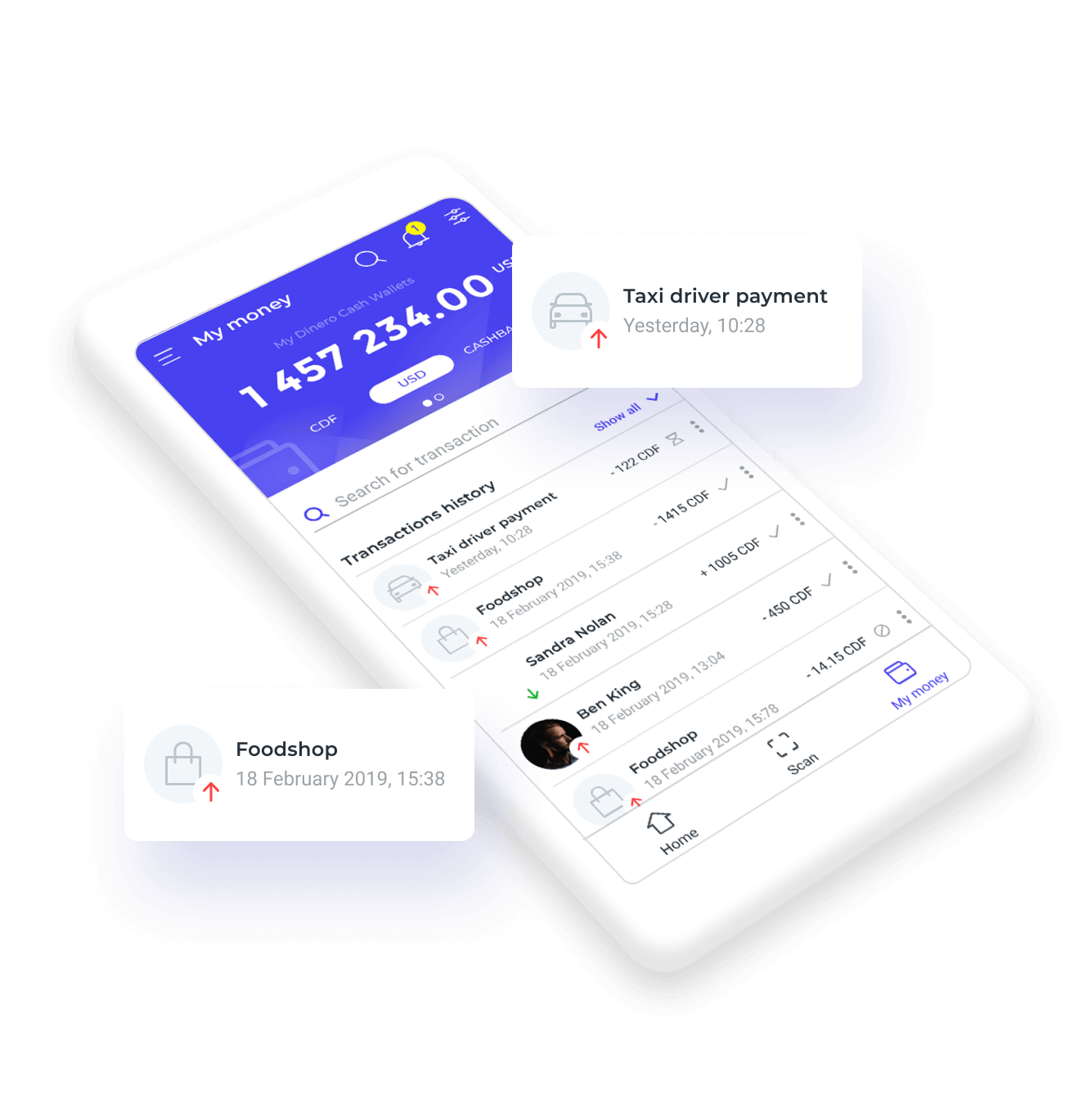

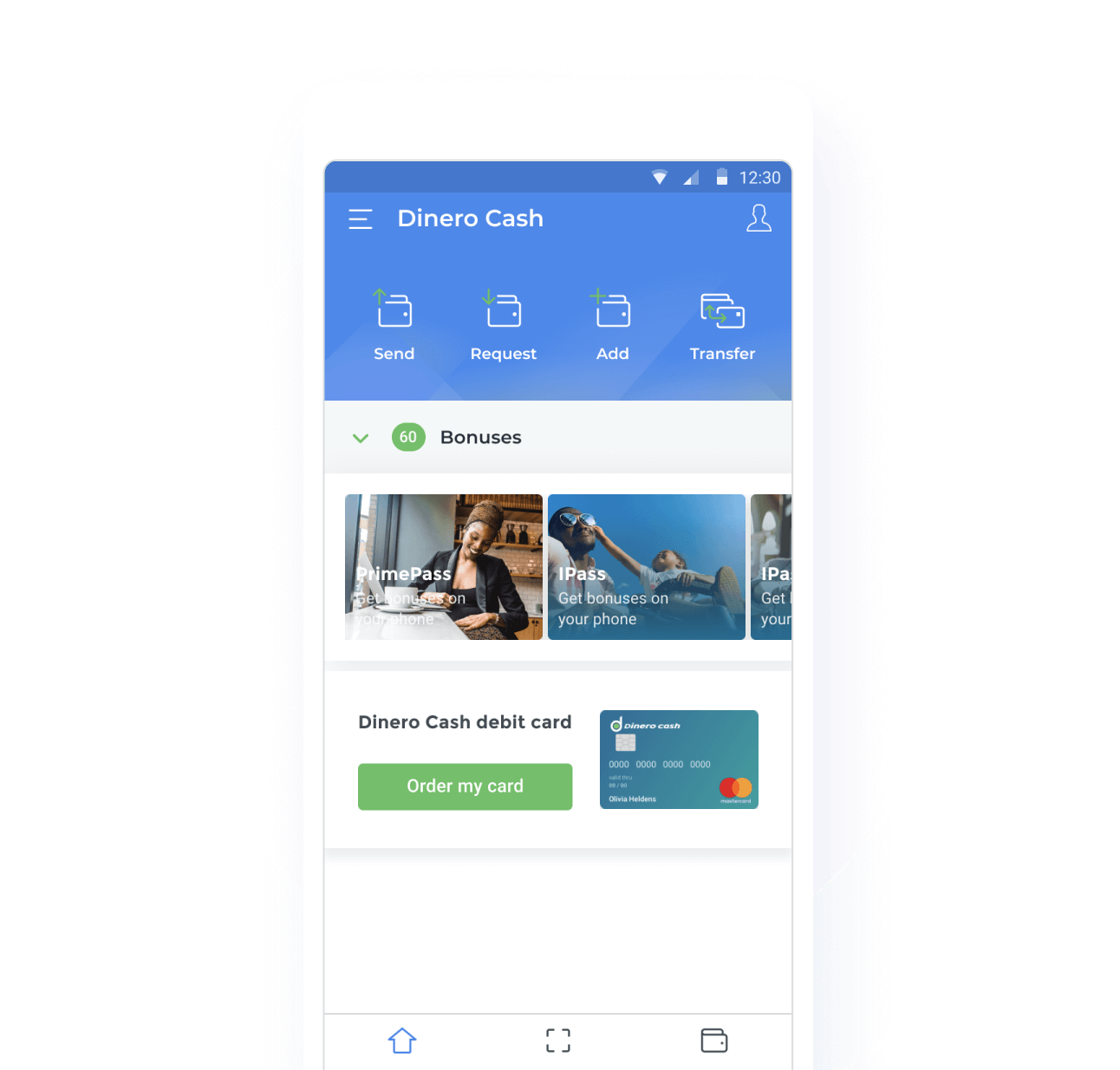

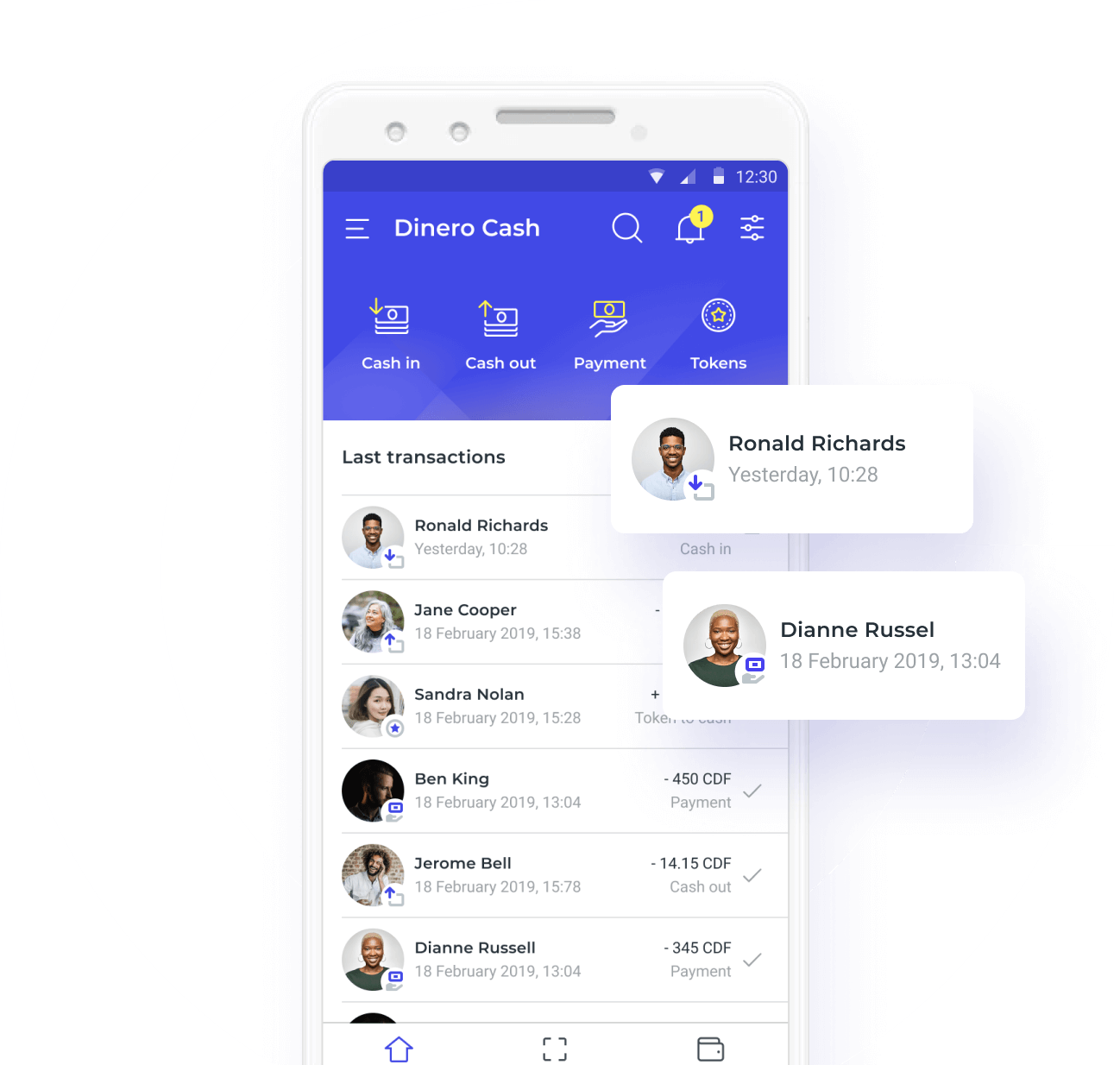

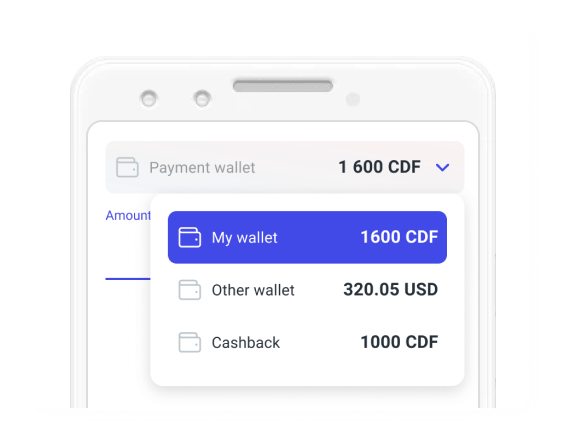

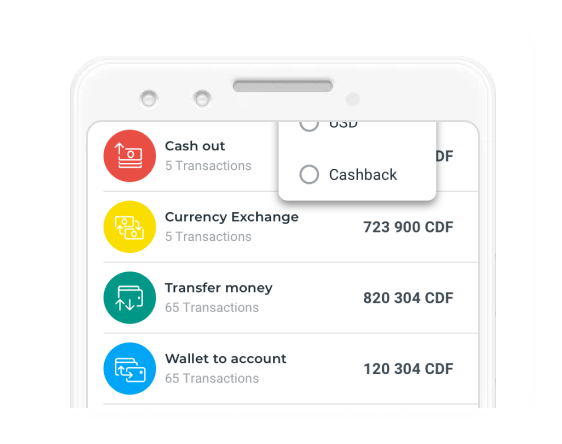

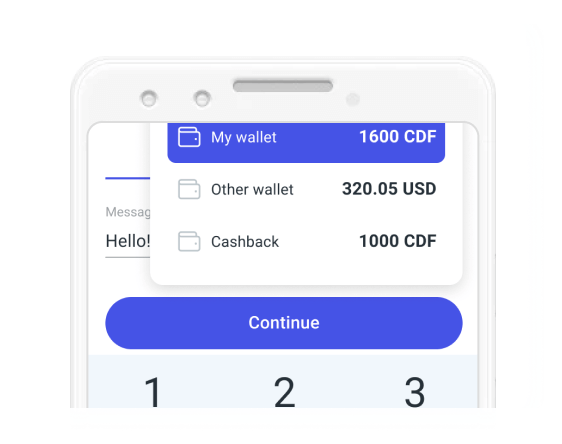

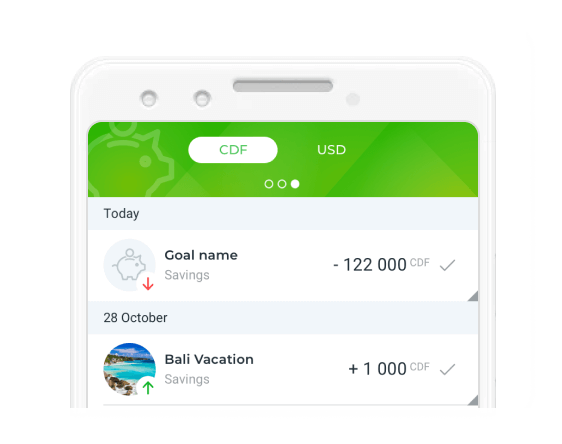

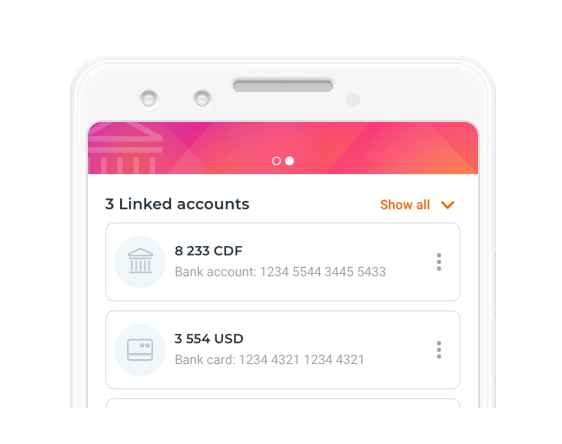

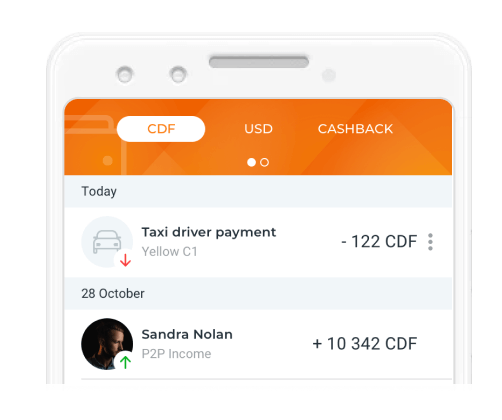

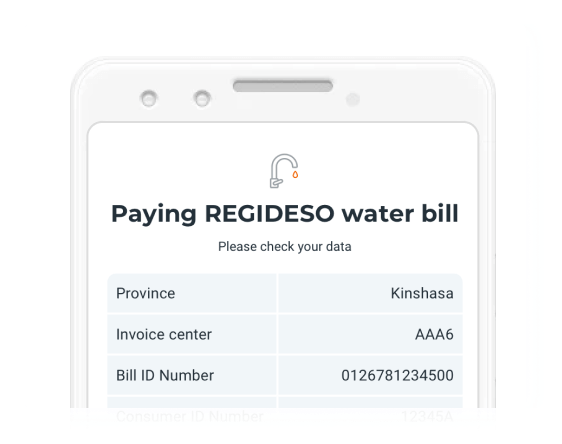

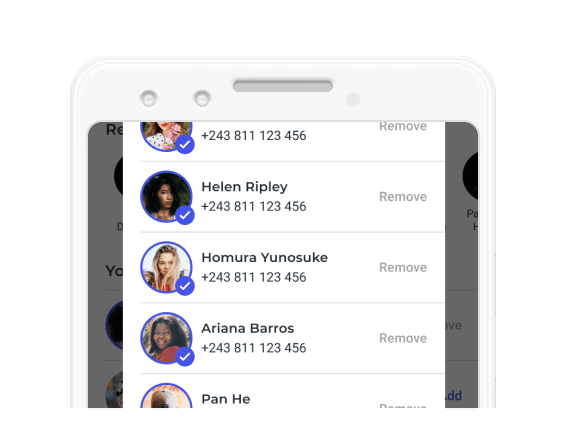

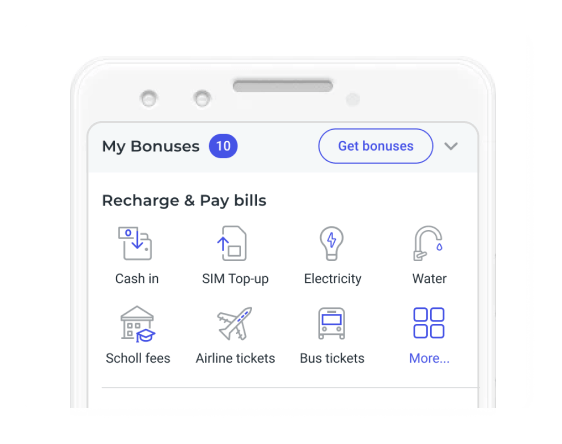

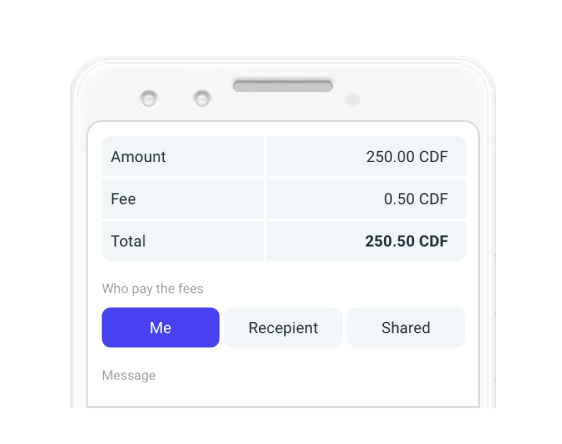

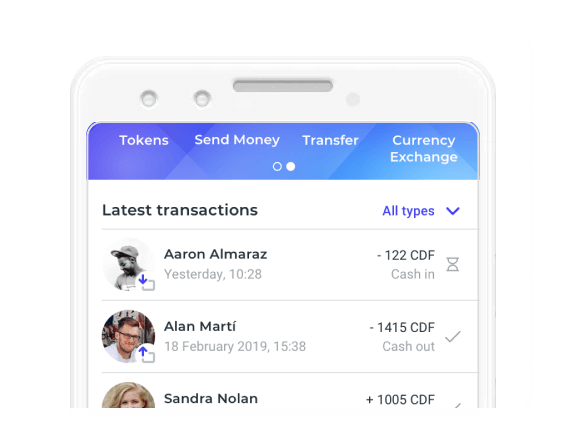

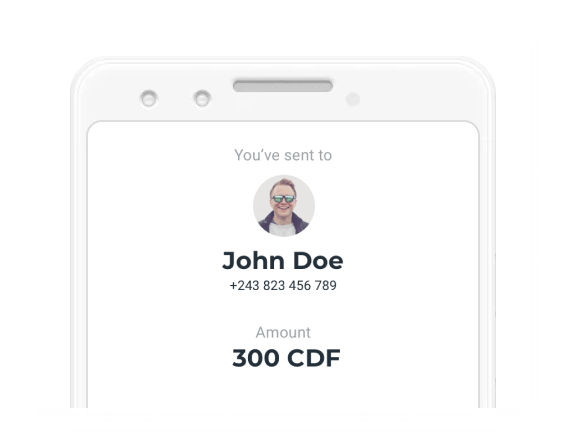

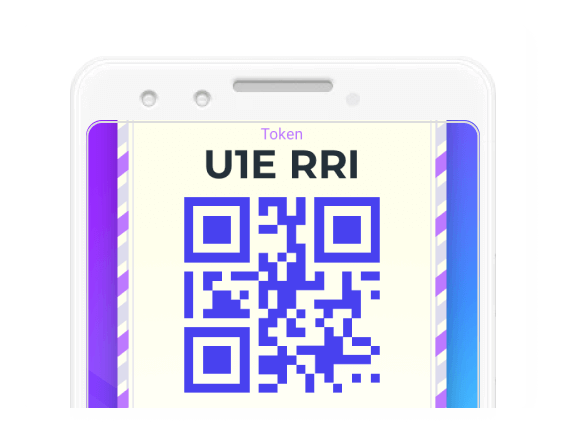

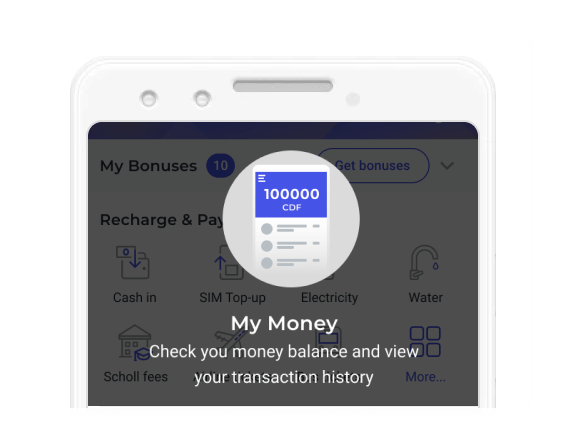

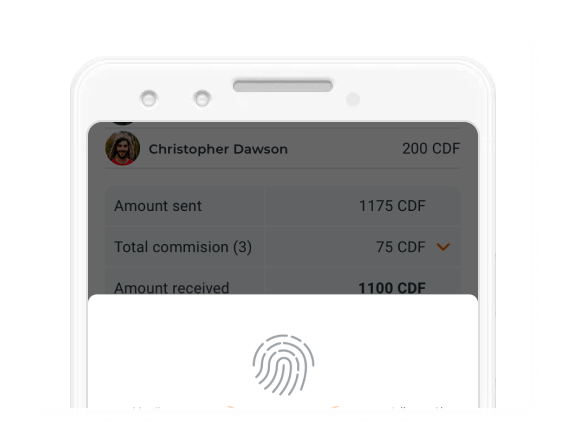

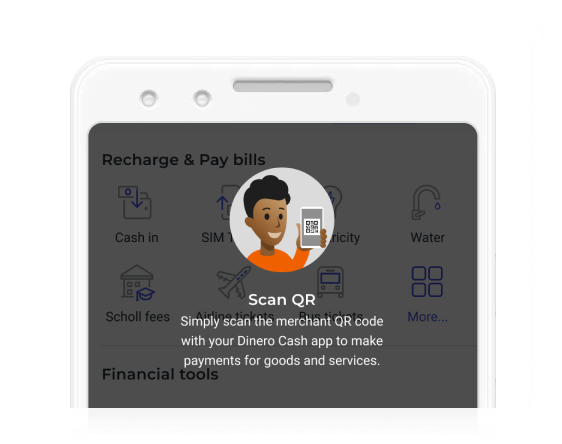

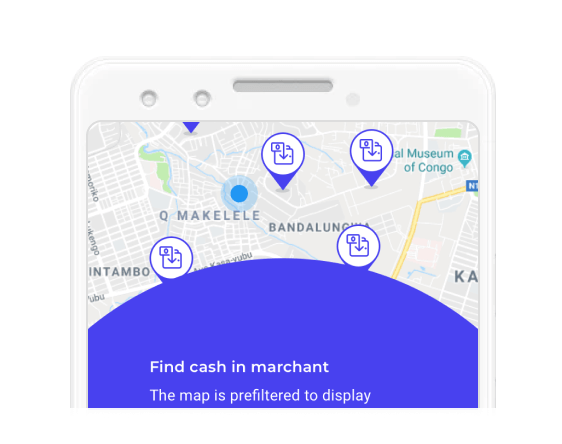

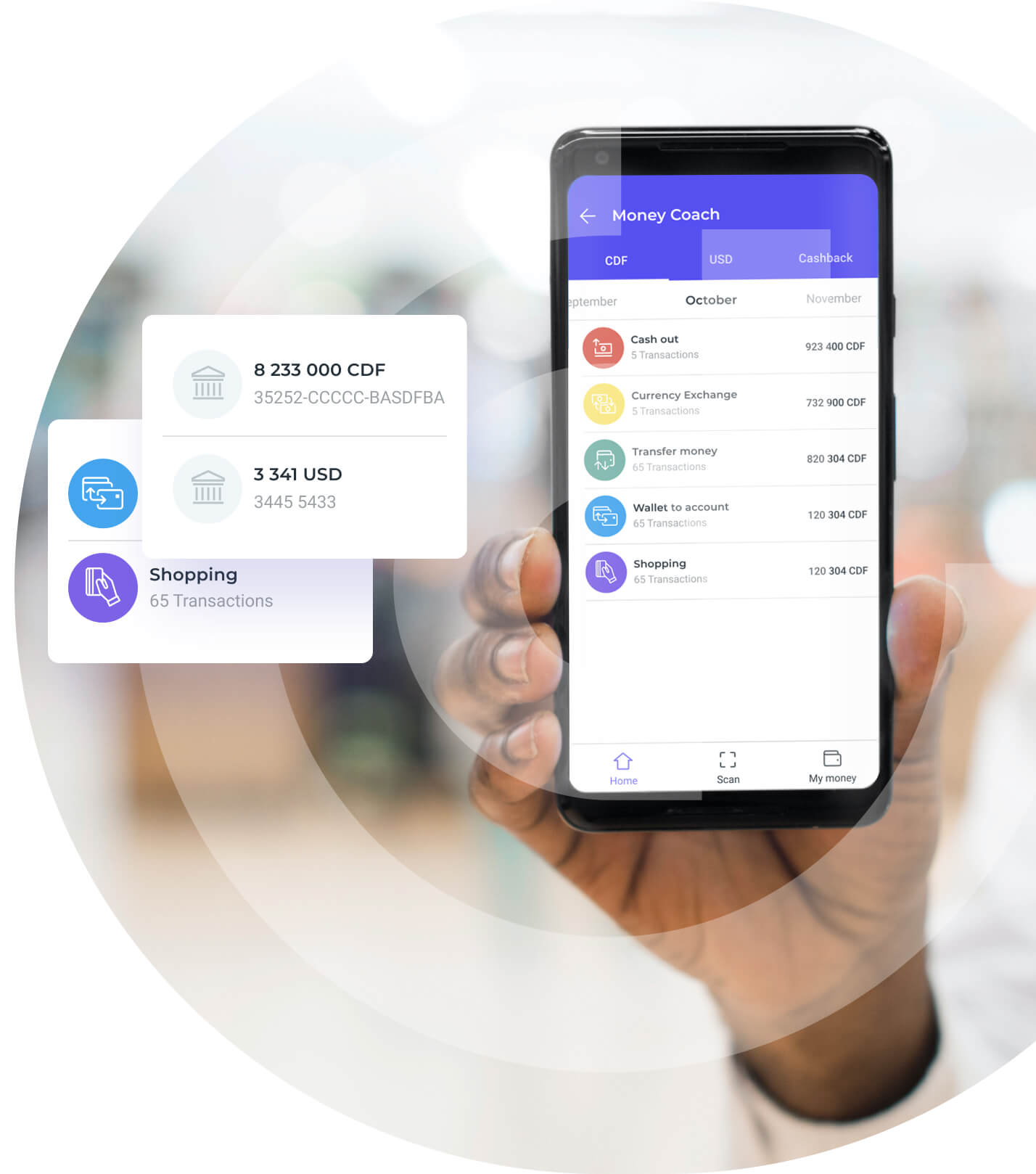

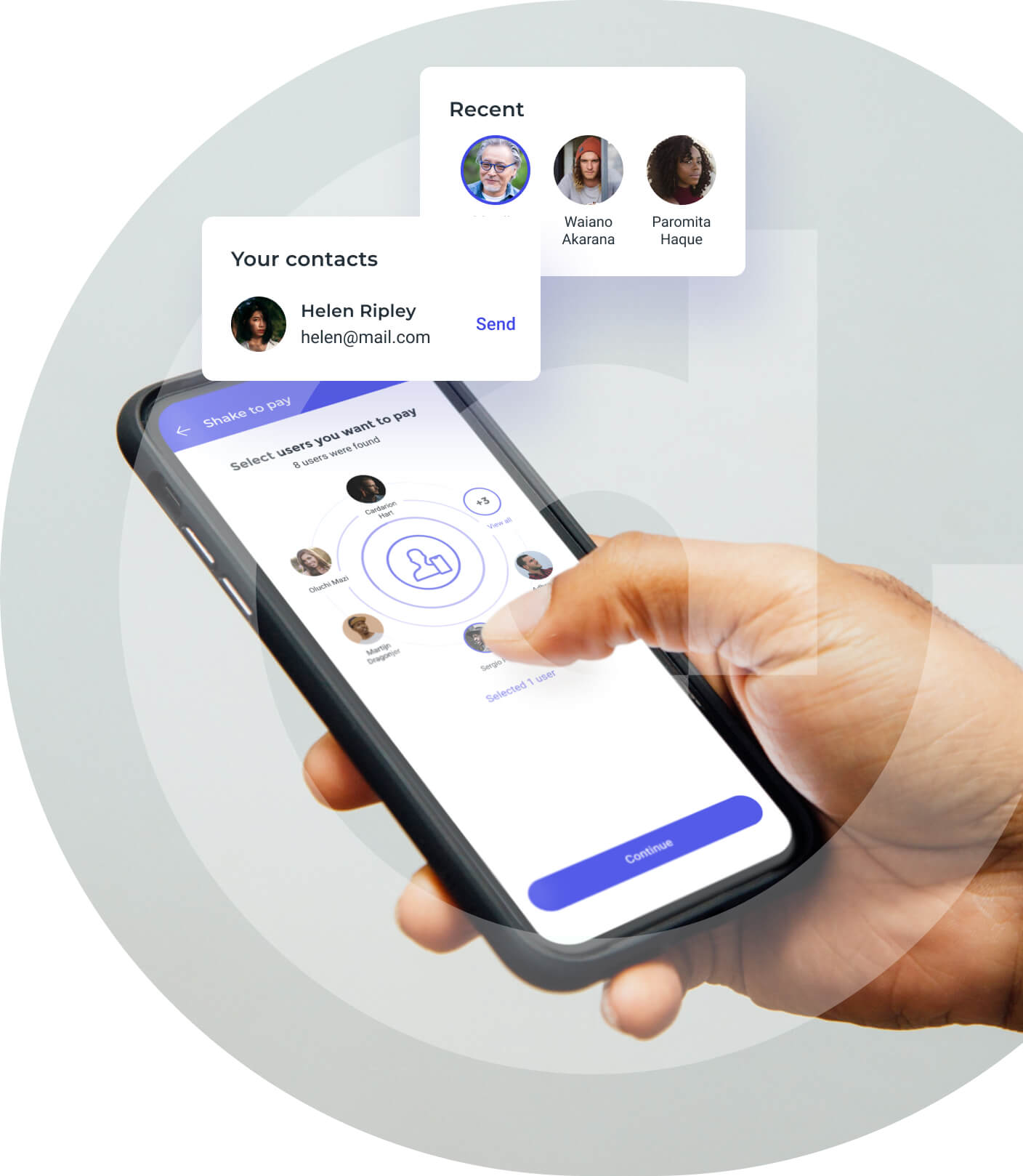

Instant payments and money transfers: Simplify everyday life with Dinero Cash digital banking

No more cash or credit cards needed, easily manage your finances on-the-go. Say goodbye to ATM searches, everything you need is in the Dinero Cash app. Upgrade to a smarter way of banking with Dinero Cash.

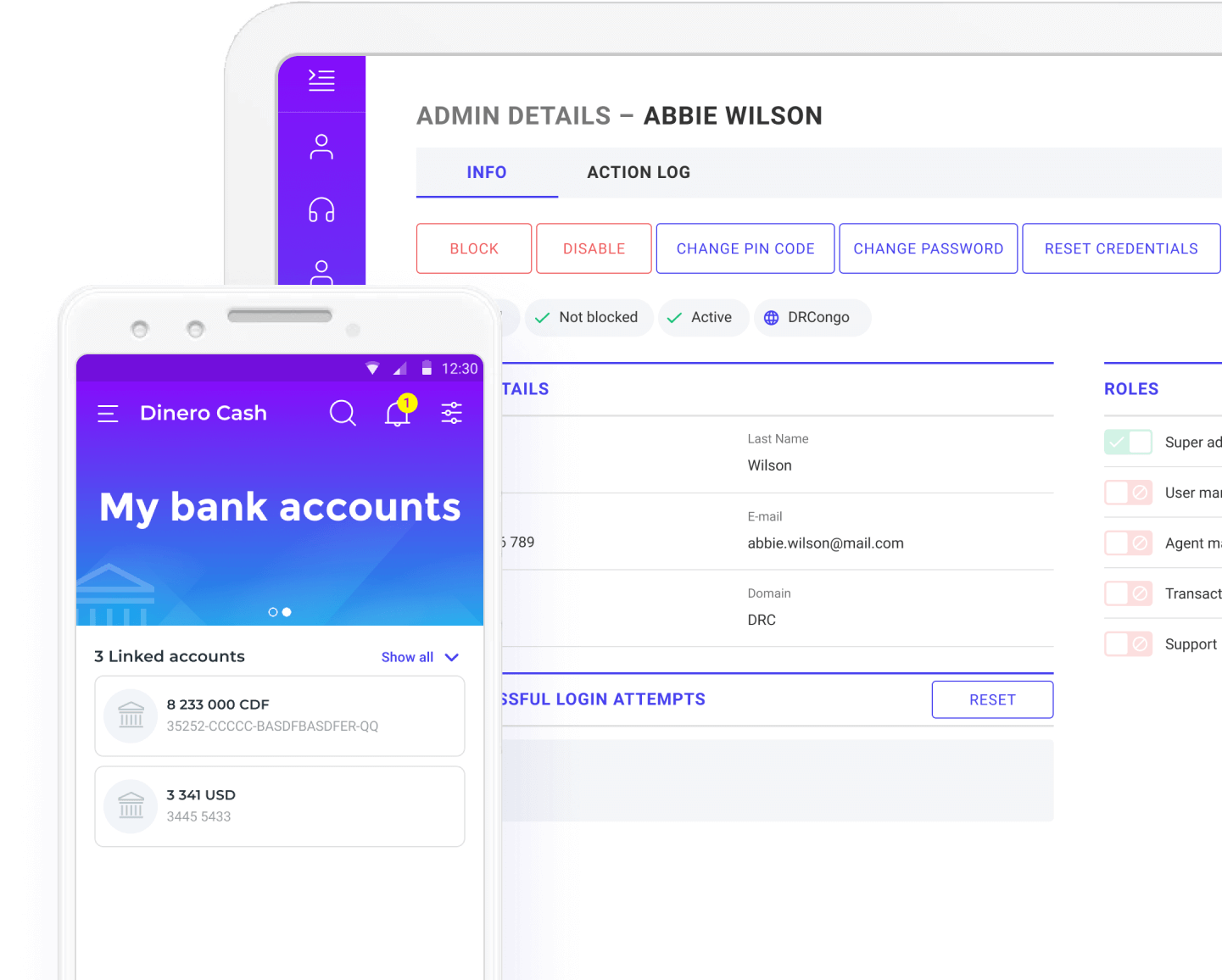

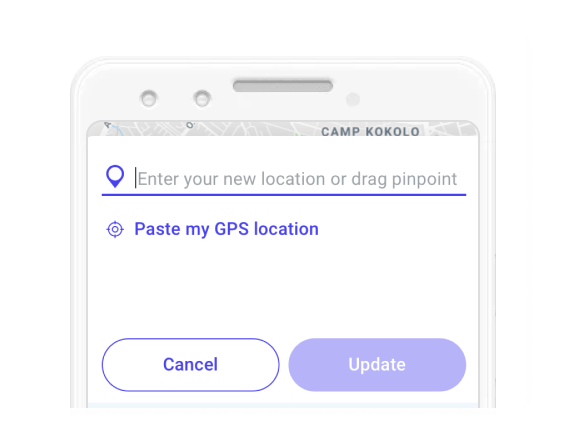

Customize your business with Dinero Cash

Our platform is fully customizable, can be deployed in as little as three months, and provides a comprehensive ecosystem that delivers quick ROI and empowers your user base. Take control of your financial operations and tailor them to your specific needs with Dinero Cash's flexibility